| (4) | Requesting a printed proxy card and completing, signing, dating and promptly mailing the proxy card in the envelope provided. |

Any proxy given pursuant to the solicitation may be revoked at any time prior to being voted. A proxy may be revoked by the record holder or other person entitled to vote (a) by attending the meeting in person and voting the shares, (b) by executing another proxy dated as of a later date, or (c) by notifying the Secretary of the Company in writing, at the Company’s address set forth on the notice of the meeting, provided that such notice is received by the Secretary prior to the meeting date. All shares represented by valid proxies will be voted at the meeting. Proxies will be voted in accordance with the specification made therein or, in the absence of specification, in accordance with the provisions of the proxy. The Board of Directors has fixed the close of business on December 16, 2015,14, 2016, as the record date for determining the holders of common stock of the Company (the “Common Stock”) entitled to notice of and to vote at the annual meeting. The 1

Common Stock is listed for trading on the New York Stock Exchange. At the close of business on the record date there were

outstanding and entitled to vote 29,606,885 shares29,640,800 of Common Stock, which are entitled to one vote per share on all matters which properly come before the annual meeting. The presence in person or by proxy of the holders of a majority of the outstanding shares of Common Stock entitled to vote is required to constitute a quorum for the transaction of business at the meeting. The inspector of elections, who determines whether or not a quorum is present at the annual meeting, will count abstentions and broker non-votes, which are discussed further below, as shares of Common Stock that are present and entitled to vote for purposes of determining the presence of a quorum. There must be a quorum for the meeting to be held. The Company has appointed Computershare as the inspector of elections for the annual meeting. Votes cast by proxy or in person at the annual meeting will be tabulated by the inspector of elections appointed for the annual meeting. For Proposal One regarding the election of directors, each nominee must receive an affirmative vote of a majority of votes cast, either in person or represented by proxy at the meeting, to be elected to the Board of Directors. Shareholders are not entitled to cumulate votes in electing directors. For Proposal Two regarding the approval of the Company’s 2013 Amended and Restated Equity Incentive Plan, the affirmative vote of a majority of the votes cast will be required for approval of the proposal. For Proposal Three (regarding the advisory vote on the executive compensation of the Company’s named executive officers) and Proposal ThreeFive (regarding the ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm for fiscal year 2016)2017), the affirmative vote of a majority of the votes cast will be required for approval of the proposals. For Proposal Four (regarding the frequency of the advisory vote on executive compensation) the option receiving the greatest number of votes will be the frequency that shareholders approve. The votes on Proposal TwoThree (regarding executive compensation), Proposal Four (regarding frequency of say on pay) and Proposal ThreeFive (regarding the ratification of our independent auditors) are advisory in nature and are nonbinding. Abstentions and broker non-votes will not be considered votes cast with respect to any of the Proposals One, Three, Four and Five and as a result, they will have no effect on the vote relating to those proposals. With respect to Proposal Two, abstentions will be considered votes cast and as a result, they will have the same effect as voting “no” on Proposal Two; however, broker non-votes will not be considered votes cast and therefore, they will have no effect on the vote relating to Proposal Two. Broker non-votes occur when a person holding shares through a bank or brokerage account does not provide instructions as to how his or her shares should be voted and the broker does not exercise discretion to vote those shares on a particular matter. Brokers may not exercise discretion to vote shares as to non-routine matters, which at the 20162017 annual meeting include the election of directors, the approval of the 2013 Amended and Restated Equity Incentive Plan, the advisory vote on executive compensation and the advisory votesvote on the frequency of the advisory vote on executive compensation. Brokers may exercise discretion to vote shares as to which instructions are not given with respect to routine matters, which at the 20162017 annual meeting includes the ratification of the selection of Ernst & Young LLP as the Company’s independent registered public accounting firm. PROPOSAL ONE: ELECTION OF DIRECTORS The Company’s Amended and Restated Bylaws provide for a board of directors that consists of not less than seven (7) or more than twelve (12) members, as may be fixed from time to time by the Board of Directors. The Company’s Restated Certificate of Incorporation provides that the directors will be divided into three classes, with the classes serving for staggered, three-year terms such that approximately one-third of the directors are elected each year. Majority Voting in Director Elections and Irrevocable Resignations Pursuant to the Company’s Amended and Restated Bylaws, a director nominee is elected to the Board if the votes cast for the nominee exceed the votes cast against the nominee. Abstentions will have no effect on the election of directors since only votes “For” or “Against” a nominee will be counted. Under the Company’s Corporate Governance Guidelines, the Board will nominate only those persons who tender, in advance, irrevocable resignations, which are effective upon a director’s failure to receive the required vote at any annual meeting at which they are nominated for re-election and Board acceptance of the resignation. The Board will act on the resignation, taking into account the recommendation of the Nominating & Corporate Governance Committee, and publicly disclose its decision within 90 days from the date of the certification of the election results. Any director who tenders such a resignation in accordance with the Corporate Governance Guidelines will not participate in the Nominating & Corporate Governance Committee recommendation or Board decision on the resignation. We entered into an agreement with First Pacific Advisors, LLC and certain of its affiliates named in the agreement (collectively, “FPA”) dated October 18, 2016, (the “FPA Agreement”). Pursuant to the FPA Agreement, the Board appointed Mr. Nils E. Larsen as a new independent director effective October 18, 2016. As the new independent director under the FPA Agreement, Mr. Larsen tendered an irrevocable resignation letter pursuant to which he will immediately resign from the Board -2-

and all applicable committees thereof if, at any time during the Standstill Period (as defined below), FPA fails to beneficially own at least 10% of the Company’s Common Stock. The Standstill Period is the period from October 18, 2016, until the earlier of (i) the date that is fifteen (15) business days prior to the deadline for the submission of stockholder nominations for the 2020 Annual Meeting pursuant to the Bylaws and (ii) the date that is 100 days prior to the first anniversary of the 2019 Annual Meeting. See the “Certain Relationships and Related Transactions – The FPA Agreement”section of this proxy statement beginning on page 42 for further detail on the FPA Agreement. If the Board does not accept the resignation of a director in any of the circumstances described above, the director will continue to serve until the next annual meeting and until his or her successor is duly elected, or until his or her earlier resignation or removal. If the Board accepts the resignation, then the Board, in its sole discretion, may fill any resulting vacancy or may decrease the size of the Board as provided for and in accordance with the Bylaws. Resignation and Replacement of Mr. James J. Morris as a Director of the Company Mr. James J. Morris has informed the Board of his intention to retire from the Board of Directors and the Company’s Audit and Enterprise Risk Committees at the expiration of his current term at the conclusion of the 2017 annual meeting, and therefore will not stand for reelection at the 2017 annual meeting. The process to select a nominee to replace Mr. Morris is ongoing, and it is currently anticipated that at some time following the 2017 annual meeting, a nominee will be selected by the Nominating & Corporate Governance Committee and approved by the Board. Pursuant to the FPA Agreement, as part of the Company’s process to select a candidate to replace Mr. Morris, FPA shall have the right to submit potential candidates (the “FPA Candidates”) to the Nominating & Corporate Governance Committee to be considered for election as a director. The Nominating & Corporate Governance Committee shall give due and careful consideration to the FPA Candidates and share with FPA information pertaining to the other final proposed candidates it considers to replace Mr. Morris. Accordingly, by resolution of the Board of Directors effective at the end of the 2017 annual meeting, the Board of Directors will accept Mr. Morris’s resignation and reduce the number of authorized members of the Board of Directors to nine. At such time that Mr. Morris’s replacement nominee is identified and approved by the Board, the size of the Board will be increased to ten directors, and the replacement nominee will be appointed to fill the vacancy and assigned to the class of directors whose term expires at the 2020 annual meeting. See the “Certain Relationships and Related Transactions – The FPA Agreement” section of this proxy statement beginning on page 42 for further detail on the FPA Agreement. 2

The Board of Directors recommends a vote FOR its director nominees named below. Information as to each nominee and each director whose term will continue after the 20162017 annual meeting is provided below. Unless otherwise instructed, it is the intention of the persons named in the accompanying proxy to vote shares represented by properly executed proxies FOR the election of the nominees named below. The Board of Directors knows of no reason why any of its nominees will be unable or unwilling to serve. If any nominee becomes unavailable to serve, the Board of Directors intends for the persons named as proxies to vote for the election of such other persons, if any, as the Board of Directors may recommend. Nominees to the class of directors whose term will expire at the 20192020 annual meeting: Paul V. Haack

Senior Partner (Retired), Deloitte & Touche LLP. Age 65.

Prior to 2006, Mr. Haack was a Senior Partner with Deloitte & Touche LLP (an international public accounting firm). He is currently a trustee of the University of Montana Foundation. He has been a director of the Company since 2006.

During his tenure at Deloitte, Mr. Haack was a leader of its Aerospace and Defense Practice, which provided him with knowledge and experience relevant to the Company’s industry. Mr. Haack also gained extensive experience in complex mergers and acquisitions and capital structure issues from his career at Deloitte, and from his tenure as director and Audit Committee Chair at SonoSite, including during Sonosite’s successful sale to FujiFilm for which he served on the Transaction Committee. As a practicing CPA for 33 years, he has extensive expertise in finance, accounting and regulatory matters related to financial reporting, and has experience with the complexities of doing business overseas. The broad skillset he brings to the Board enhances the Board’s oversight of financial reporting, enterprise risks, as well as the Company’s strategy in the markets in which the Company operates and positions him well to serve as the Company’s lead independent director.

Scott E. Kuechle

Executive Vice President and Chief Financial Officer (Retired), Goodrich Corporation. Age 56.

Prior to July 2012, Mr. Kuechle was the Executive Vice President and Chief Financial Officer of Goodrich Corporation (an aerospace and defense company) since August 2005. He is also a director of Kaman Corporation and Wesco Aircraft Holdings, Inc. He has been a director of the Company since 2012.

Mr. Kuechle’s extensive experience within the aerospace and defense industry during his 29-year tenure at Goodrich and ongoing board experience at two other aerospace public companies provide relevant and valuable insights to the Board’s oversight of the Company’s strategic plans and initiatives. This industry experience, coupled with his deep expertise in corporate finance, mergers and acquisitions, and financial controls and analysis, provide the Board with a powerful skillset to draw upon as the Company continues to execute its strategic plan with a focus on organic growth, good-fit mergers and acquisitions, and operational excellence. In addition, Mr. Kuechle’s experience in complex corporate finance matters, including capital allocation, strengthen the Audit Committee’s oversight of audit, financial reporting and financial risk matters.

Curtis C. Reusser

Chairman, President and Chief Executive Officer, Esterline Technologies Corporation. Age 55

Mr. Reusser has been Chairman, President and Chief Executive Officer of the Company since March 2014. Prior to that time, he was President and Chief Executive Officer of the Company from October 2013 to March 2014. Previously, he was President, Aircraft Systems of UTC Aerospace Systems for United Technologies Corporation (“UTC”) (a provider of a broad range of high-technology products and services to the global aerospace and building systems industries) from July 2012 to October 2013. Prior to that time, he was President of the Electronic Systems segment of Goodrich Corporation (an aerospace and defense company that was acquired by UTC in July 2012) from January 2008 to July 2012. He has been a director of the Company since 2013.

Mr. Reusser brings to the Board over 30 years of experience in the aerospace and defense industry, which significantly strengthens the Board’s oversight of the development and execution of the Company’s strategic plans and initiatives. With his engineering background and substantive leadership experience at Goodrich Corporation and United Technologies Corporation, Mr. Reusser adds a “hands-on” dynamic to the Board. Mr. Reusser has direct experience in growing and leading businesses that are complementary to Esterline’s, including sensors and systems, power systems, and intelligence, surveillance, and reconnaissance. Mr. Reusser’s extensive and relevant industry experiences and experience in merger and acquisition transactions add significantly to the Board’s oversight of the Company’s global operations, operational excellence initiatives, strategic transactions and strategy deployment.

3

Nominee to the class of directors whose term will expire at the 2017 annual meeting:

Michael J. Cave Senior Vice President (Retired), The Boeing Company. President (Retired), Boeing Capital Corporation. Age 55.56. Mr. Cave served as a Senior Vice President of The Boeing Company (a leading aerospace company and manufacturer of commercial jetliners and military aircraft), from January 2010 to May 2014. During this same time period, he also served as President of Boeing Capital Corporation (a wholly owned Boeing subsidiary that is primarily responsible for arranging, structuring and providing financing for Boeing’s commercial airplane and space and defense products). Prior to that time, he served as Senior Vice President of Business Development and Strategy at The Boeing Company, as well as Vice President of Business Strategy & Marketing of Boeing Commercial Airplanes from 2006 until late 2009. He is the non-executive chairman of the board of Harley Davidson and also serves as a director of AirCastle Ltd., and Ball Corporation and Harley Davidson.Corporation. He has been a director of the Company since November 2015. Mr. Cave’s skills, expertise and experience in financial services, strategic planning, operations management and business development he gained through senior leadership roles at The Boeing Company make him a valuable member of the Board. His insights into the various products under development and entering production at aerospace original equipment manufacturers and the many high-level customer relationships that he developed in his time at Boeing are particularly helpful in guiding the Company on strategic matters. In addition, Mr. Cave provides the benefits of service on the boards of other publicly traded companies and has significant experience with mergers and acquisitions, including integration of newly acquired businesses, which enhances the Board’s strategic transaction oversight resources. -3-

Anthony P. Franceschini President and Chief Executive Officer (Retired), Stantec Inc. Age 65. Prior to May 2009, Mr. Franceschini was the President and Chief Executive Officer of Stantec Inc. (an engineering, architecture and related professional services design firm), having held such positions since June 1998. He has served and continues to serve as a director of Stantec Inc. since March 1994. He is chairman of the board for ZCL Composites Inc. and also a director of Aecon Group Inc. and is on the advisory boards of two other private companies. He has been a director of the Company since 2002. Mr. Franceschini has substantive experience in the area of mergers and acquisitions, having guided Stantec Inc. through a period of significant growth facilitated through many successful acquisitions, which enhances the Board’s oversight of strategic transactions and other growth plans. His understanding of the acquisition process and post-acquisition integration is beneficial to the Board and management as acquisitions and effective integration of acquisitions remain key focus areas for the Company. Additionally, as a Canadian citizen, Mr. Franceschini’s familiarity with Canadian business and banking practices adds meaningful oversight of Esterline’s investments in Canada. Nils E. Larsen Senior Operating Advisor, The Carlyle Group. Age 46. Mr. Larsen has been the Senior Operating Advisor of The Carlyle Group (a global alternative asset manager) since September 2013. He is also the President of SZR Consulting, LLC (a business consulting firm) and the Managing Director of Equity Group Investments, LLC (a private investment firm), having held those positions since September 2013 and March 2013, respectively. Prior to that time, he was President and Chief Executive Officer of the Tribune Company from May 2011 to March 2013 and Executive Vice President from December 2008 to March 2013. He is Chairman of Liberty Tire Recycling, LLC and a director of Vantage Drilling International and two other private companies. He has been a director of the Company since October 2016 and is nominated for election to the Board pursuant to the FPA Agreement and following the review and recommendation of the Nominating & Corporate Governance Committee. Mr. Larsen has extensive experience in financial analysis for a variety of businesses and managing a number of portfolio companies for sophisticated investment firms, which brings relevant insight into the Board’s oversight of the Company’s capital structure, financial performance and financial risks. Mr. Larsen’s management of portfolio companies includes extensive strategic, budget and operational responsibilities, which will enhance the Board’s oversight of the Company’s strategic plan and budgets. Mr. Larsen also brings deep experience in structuring, negotiating and managing business acquisitions and divestitures to the Board’s oversight of the Company’s merger and acquisition activities and evaluation of the performance of such transactions. Continuing directors: Delores M. Etter Professor, Department of Electrical Engineering Distinguished Fellow, Darwin Deason Institute for Cyber Security Southern Methodist University, Dallas, TX. Age 68.69. Dr. Etter has been a member of the Department of Electrical Engineering at Southern Methodist University since June 2008. She holds the Caruth Professorship in Engineering Education and is a Distinguished Fellow in the Darwin Deason Institute for Cyber Security. Dr. Etter is a member of the National Academy of Engineering, a former member of the National Science Board, and a Fellow of the Institute of Electrical and Electronic Engineers. She is also a director of Stantec Inc. She has been a director of the Company since 2010 and her current term expires in 2018. Dr. Etter has had multiple, substantive experiences within the U.S. Department of Defense, including serving as the Assistant Secretary of the Navy for Research, Development, and Acquisition, and as the Deputy Under Secretary of Defense for Science and Technology, as well as serving on the faculty at public and private academic institutions. These experiences, coupled with her deep technical knowledge in the areas of sensors and software and her familiarity with the Joint Strike Fighter and other military aircraft, enable Dr. Etter to provide insight and guidance to management and the Board. Anthony P. FranceschiniPaul V. Haack

President and Chief Executive OfficerSenior Partner (Retired), Stantec Inc.Deloitte & Touche LLP. Age 64.66.

Prior to May 2009,2006, Mr. FranceschiniHaack was the President and Chief Executive Officer of Stantec Inc.a Senior Partner with Deloitte & Touche LLP (an engineering, architecture and related professional services designinternational public accounting firm), having held such positions since June 1998. He has served and continues to serve as a director of Stantec Inc. since March 1994.. He is chairmancurrently a trustee of the board for ZCL Composites Inc. and also a directorUniversity of Aecon Group Inc. and two other private companies.Montana Foundation. He has been a director of the Company since 20022006 and his current term expires in 2017.2019. During his tenure at Deloitte, Mr. Franceschini has substantiveHaack was a leader of its Aerospace and Defense Practice, which provided him with knowledge and experience relevant to the Company’s industry. Mr. Haack also gained extensive experience in the area of complex -4-

mergers and acquisitions having guided Stantec Inc. throughand capital structure issues from his career at Deloitte, and from his tenure as director and Audit Committee Chair at SonoSite, including during Sonosite’s successful sale to FujiFilm for which he served on the Transaction Committee. As a periodpracticing CPA for 33 years, he has extensive expertise in finance, accounting and regulatory matters related to financial reporting, and has experience with the complexities of significant growth facilitated through many successful acquisitions, whichdoing business overseas. The broad skillset he brings to the Board enhances the Board’s oversight of strategic transactionsfinancial reporting, enterprise risks, as well as the Company’s strategy in the markets in which the Company operates and other growth plans. His understanding ofpositions him well to serve as the acquisition process and post-acquisition integration is beneficial to the Board and management as acquisitions and effective integration of acquisitions remain key focus areas for the Company. Additionally, as a Canadian citizen, Mr. Franceschini’s familiarity with Canadian business and banking practices adds meaningful oversight of Esterline’s investments in Canada.Company’s lead independent director. Mary L. Howell Executive Vice President (Retired), Textron, Inc. Age 63.64. Prior to January 2010, Ms. Howell was the Executive Vice President of Textron, Inc. (a multi-industry company serving aircraft, automotive, defense, industrial, and finance businesses), having held such position since August 1995. Ms. Howell is also a board member of the Atlantic Council of the United States and Vectrus, Inc. She has been a director of the Company since 2011 and her current term expires in 2018. 4

Ms. Howell has extensive experience in the commercial and military markets that strengthen the Board’s oversight of the Company’s strategic plans. Her deep expertise in global operations, marketing, sales, business development and merger and acquisition transactions as well as her service on the boards of the National Association of Manufacturers and the Aerospace Industries Association enhance the Board’s oversight of strategic matters and enterprise risk. Further, her former experience as a board member of FM Global has given her insight to sophisticated risk management practices that contributes to the Board’s oversight of the Company’s complex global operations. James J. MorrisScott E. Kuechle

Executive Vice President Engineering and ManufacturingChief Financial Officer (Retired), The Boeing Company.Goodrich Corporation. Age 67.57. Prior to 2007,July 2012, Mr. MorrisKuechle was the Executive Vice President Engineering and Manufacturing,Chief Financial Officer of the Commercial Airplane business segment of The Boeing Company (a leadingGoodrich Corporation (an aerospace company and manufacturer of commercial jetliners and military aircraft), having held such positiondefense company) since August 2005. He is a Principal at J2 Ventures LLC and isalso a director of Héroux-Devtek Inc., JURAKaman Corporation and LORD Corporation.Wesco Aircraft Holdings, Inc. He has been a director of the Company since 20072012 and his current term expires in 2017.2019. Mr. Morris’ 35 years ofKuechle’s extensive experience with Boeing and over 10 years of experience serving on multiple boards provides him with deep global industry knowledge, operational experience inwithin the aerospace and defense industry during his 29-year tenure at Goodrich and familiarity withongoing board experience at two other aerospace public company governance that is difficultcompanies provide relevant and valuable insights to replicate. His general management experience as General Managerthe Board’s oversight of Boeing’s Helicopter Division and later as General Manager of Boeing’s 777, 767 and 747 programs, as well as a leader of the global Supplier Management and the Engineering and Manufacturing organization at Boeing enable him to provide insightful guidance to the Company’s strategic direction and growth plans and initiatives. This industry experience, coupled with his deep expertise in corporate finance, mergers and acquisitions, and financial controls and analysis, provide the Board with a powerful skillset to draw upon as the Company continues to execute its response tostrategic plan with a focus on organic growth, good-fit mergers and acquisitions, and operational excellence. In addition, Mr. Kuechle’s experience in complex corporate finance matters, including capital allocation, strengthen the challenges facing a global company. These experiences have provided Mr. Morris a unique understandingAudit Committee’s oversight of the complexities involved in the dynamics of a low volume, high mix engineeringaudit, financial reporting and manufacturing environment found in Esterline’s operations.financial risk matters. Gary E. Pruitt Chairman (Retired), Univar Inc.Age 6566. Prior to November 2010, Mr. Pruitt was the Chairman of Univar Inc. (a leading chemical distributor), having held such position since June 2002. He is also a director of Itron, Inc., Premera Blue Cross, and PS Business Parks, Inc., and is a trustee of Public Storage, Inc. He has been a director of the Company since 2009 and his current term expires in 2018. Mr. Pruitt brings extensive knowledge of growing and directing large, complex, global companies gained through experience in CEO and Chairman roles at international public companies that enhances the Board’s oversight of the Company’s complex global operations. Mr. Pruitt also has significant experience in mergers and acquisitions, capital structure, treasury management and international finance and taxation that is valuable to the Board’s oversight of strategic transactions and the Company’s complex organizational tax structure. Mr. Pruitt’s significant experience over the years as a director for multiple public companies enableenables him to provide meaningful insight into Board function, governance and oversight responsibilities, and his experience with manufacturing companies strengthens the Board’s oversight of the Company’s operational excellence initiatives. Curtis C. Reusser Chairman, President and Chief Executive Officer, Esterline Technologies Corporation. Age 56 Mr. Reusser has been Chairman, President and Chief Executive Officer of the Company since March 2014 and served as President and Chief Executive Officer of the Company from October 2013 to March 2014. Previously, he was President, Aircraft Systems of UTC Aerospace Systems for United Technologies Corporation (“UTC”) (a provider of a broad range of high-technology products and services to the global aerospace and building systems industries) from July 2012 to October 2013. Prior to that time, he was President of the Electronic Systems segment of Goodrich Corporation (an aerospace and defense company that was acquired by UTC in July 2012) from January 2008 to July 2012. He has been a director of the Company since 2013 and his current term expires in 2019. -5-

5Mr. Reusser brings to the Board over 30 years of experience in the aerospace and defense industry, which significantly strengthens the Board’s oversight of the development and execution of the Company’s strategic plans and initiatives. With his engineering background and substantive leadership experience at Goodrich Corporation and UTC, Mr. Reusser adds a “hands-on” dynamic to the Board. Mr. Reusser has direct experience in growing and leading businesses that are complementary to Esterline’s, including sensors and systems, power systems and avionics and communication systems. Mr. Reusser’s extensive and relevant industry experiences and experience in merger and acquisition transactions add significantly to the Board’s oversight of the Company’s global operations, operational excellence initiatives, strategic transactions and strategy deployment.

OTHER INFORMATION AS TO DIRECTORS Director Compensation The following table describes the compensation earned by persons who served as non-employee directors during fiscal 2015.2016. Employees of the Company serving on the Board or committees received no additional compensation for such service. Mr. CaveNils E. Larsen was electedappointed to the Board in November 2015October 2016 and didwas therefore not serve or earnpaid any fees in fiscal 2015.2016. Name | | Fees Earned or Paid in Cash ($) (1) | | | Stock Awards ($) (2) | | | All Other Compensation | | | Total ($) | | | | | | | | | | | | | | | | | | | | | | | | | | Name | | Fees Earned or

Paid in Cash

($) (1) | | | Stock Awards

($) (2) | | | All Other

Compensation

$ | | | Total

($) | | | Michael J. Cave | | $ | 65,000 | | | $ | 110,000 | | | $ | - | | | $ | 175,000 | | Delores M. Etter | | $ | 82,500 | | | $ | 110,000 | | | $ | — | | | $ | 192,500 | | | 88,750 | | | | 110,000 | | | | - | | | | 198,750 | | Anthony P. Franceschini | | | 75,000 | | | | 110,000 | | | | — | | | | 185,000 | | | 76,250 | | | | 110,000 | | | | - | | | | 186,250 | | Paul V. Haack | | | 100,000 | | | | 110,000 | | | | — | | | | 210,000 | | | 100,000 | | | | 110,000 | | | | - | | | | 210,000 | | Mary L. Howell | | | 90,000 | | | | 110,000 | | | | — | | | | 200,000 | | | 88,750 | | | | 110,000 | | | | - | | | | 198,750 | | Scott E. Kuechle | | | 88,750 | | | | 110,000 | | | | — | | | | 198,750 | | | 93,750 | | | | 110,000 | | | | - | | | | 203,750 | | Jerry D. Leitman (3) | | | 36,250 | | | | — | | | | — | | | | 36,250 | | | James J. Morris | | | 87,500 | | | | 110,000 | | | | — | | | | 197,500 | | | 88,750 | | | | 110,000 | | | | - | | | | 198,750 | | Gary E. Pruitt | | | 80,000 | | | | 110,000 | | | | — | | | | 190,000 | | | 68,750 | | | | 110,000 | | | | - | | | | 178,750 | | Henry W. Winship IV (3) | | | 35,000 | | | | — | | | | — | | | | 35,000 | | |

____________________ (1) | Amounts in this column represent retainers and chair fees. |

(2) | Amounts in this column represent the aggregate grant date fair value of awards granted during fiscal 2015,2016, computed in accordance with Accounting Standards Codification Topic 718 (ASC 718). |

For fiscal 2016, the Company paid the following cash fees to non-employee directors: (3) | Mr. Leitman retired from the Board effective March 11, 2015, and Mr. Winship resigned from the Board effective March 11, 2015.

|

| Through | | | Beginning | | | April 2016 | | | May 2016 | | Non-Employee Director Annual Retainer | $ | 55,000 | | | $ | 55,000 | | Lead Independent Director Additional Annual Retainer | | 25,000 | | | | 25,000 | | Audit Committee Member Annual Retainer | | 12,500 | | | | 12,500 | | Audit Committee Chair Additional Annual Retainer | | 12,500 | | | | 12,500 | | Compensation Committee Member Annual Retainer | | 7,500 | | | | 7,500 | | Compensation Committee Chair Additional Annual Retainer | | 7,500 | | | | 7,500 | | Regulatory Compliance Subcommittee Member Annual Retainer | | 7,500 | | | | 7,500 | | Regulatory Compliance Subcommittee Chair Additional Annual Retainer | | 7,500 | | | | 7,500 | | Nominating & Corporate Governance Committee Member Annual Retainer | | 5,000 | | | | 7,500 | | Nominating & Corporate Governance Committee Chair Additional Annual Retainer | | 5,000 | | | | 7,500 | | Enterprise Risk Committee Member Annual Retainer | | 5,000 | | | | 7,500 | | Enterprise Risk Committee Chair Additional Annual Retainer | | 7,500 | | | | 7,500 | |

The Compensation Committee reviews director remuneration periodically, and seeks information and advice from its compensation consultant, Semler Brossy, to assist the Committee’s consideration. Typically,Pursuant to such a review, the Committee reviewsconfirmed it was generally satisfied with the level and considers currentstructure of director fees overall, but recommended and the Board approved increases in May 2016 to $7,500 for the annual Chair and Member retainer for the Nominating & Corporate Governance Committee as well as the annual Member retainer for the Enterprise Risk Committee. The fee increases were based on updated market benchmark information concerning practices common among the then-current17-company peer group the Company references for purposes of making executive pay comparisons, and based on public company practices more generally. Following -6-

generally as well as consideration of the responsibilities of the affected positions. Further information about the peer group can be found in the Compensation Discussion and Analysis section of this practice, the Committee reviewed, but made no changes to director compensation in fiscal 2015. In general, the Committee believes the current director remuneration program: (1) is competitive; (2) retains a sound balance between equity-based compensation and cash fees; and (3) focusesproxy statement starting on directors’ overall stewardship responsibility to the Company by better linking pay to the role each director holds, rather than paying for discrete activity, such as meeting attendance fees. The Company paid the cash fees to non-employee directors set forth below:page 12. | | | | | Non-Employee Director Annual Retainer

| | $ | 55,000 | | Lead Independent Director Additional Annual Retainer

| | | 25,000 | | Audit Committee Member Annual Retainer

| | | 12,500 | | Audit Committee Chair Additional Annual Retainer

| | | 12,500 | | Compensation Committee Member Annual Retainer

| | | 7,500 | | Compensation Committee Chair Additional Annual Retainer

| | | 7,500 | | Regulatory Compliance Subcommittee Member Annual Retainer

| | | 7,500 | | Regulatory Compliance Subcommittee Committee Chair Additional Annual Retainer

| | | 7,500 | | Nominating & Corporate Governance Committee Member Annual Retainer

| | | 5,000 | | Nominating & Corporate Governance Committee Chair Additional Annual Retainer

| | | 5,000 | | Strategy & Technology Committee Member Annual Retainer

| | | 7,500 | | Strategy & Technology Committee Chair Additional Annual Retainer

| | | 5,000 | |

All annual retainers are paid quarterly in arrears. The Company also reimburses non-employee directors for reasonable expenses incurred in attending Board and committee meetings. In addition, the Company makes an annual issuance of fully-paid Common Stock to each non-employee director serving on the Board the day after each annual meeting of shareholders. In fiscal 2015,2016, each non-employee director who continued service on the Board after the annual meeting date was issued $110,000 of fully-paid Common Stock, an increase of $10,000 over the value of Common Stock issued in fiscal 2014.Stock. The number of shares of Common Stock issued is determined based on the closing price of our Common Stock on the date of the annual meeting, as reported in the Wall Street Journal the following day. During fiscal 2015,2016, shares to non-employee directors were issued under the Company’s 2013 Equity Incentive Plan. Board policy requires non-employee directors to acquire and hold shares of the Company’s Common Stock that are equal to or greater in value than five times the amount of the annual cash retainer for Board service, which is currently $55,000, as described above. All non-employee directors, other than Mr.Messrs. Kuechle, Cave and Mr. Cave,Larsen, are to achieve this stock ownership level by the end of the second fiscal quarter of 2017, and met the share ownership requirement as of the end of fiscal 2015.2016. Mr. Kuechle is to achieve the required ownership level by the fifth anniversary of his election to the Board, or December 2017, and met the share ownership requirement as of the end of fiscal 2015. Mr.2016. Messrs. Cave isand Larsen are to achieve the required ownership level by the fifth anniversary of histheir election to the Board, or November 2020. 2020 and October 2021, respectively.6

Board and Board Committees There were eightnine meetings of the Board of Directors during fiscal 2015.2016. During fiscal 2015,2016, each director attended at least 75% of the total number of meetings of the Board of Directors and Board committees of which he/she was a member. The Board recognizes that there is no single best approach to the structure of Board leadership and therefore, our Corporate Governance Guidelines provide that there shall be a Chairman of the Board who may or may not be a member of management. In the event the Chairman is a member of management, a Lead Independent Director shall be selected from among the non-management directors. This gives the Board the flexibility to structure the Board’s leadership in the best interests of the Company. Currently, Mr. Reusser serves as the Chairman of the Board, and due to Mr. Reusser’s current position with the Company, Mr. Haack currently serves as the Lead Independent Director. The Chairman of the Board, if a non-management director, presides over executive sessions of non-management directors, which are held on a regular basis, generally at each scheduled Board meeting. Because the Chairman of the Board is an employee of the Company, the Lead Independent Director, Mr. Haack, presides over the sessions. Non-management directors who are considered independent under the NYSENew York Stock Exchange (“NYSE”) independence listing standards also meet in executive session at least once annually. In addition, the Audit Committee has adopted the practice of reserving time at each meeting to meet without members of Company management present. The Compensation Committee and the Nominating & Corporate Governance Committee also have adopted a similar practice of meeting periodically without members of Company management present. Board’s Role in Risk Oversight.The Company has traditionally identified and evaluated risk as part of its annual strategic planning process (carried out through its business units) and will continue to do so. Beginning in 2009,In addition, the Company developed and implemented an enterprise risk management program (“ERM”) which incorporates thesenior officer and business unit risk assessments.assessments, including those identified as part of the strategic planning process. The Company’s ERM program is a systematic approach to risk assessment and mitigation, which is designed to measure, manage and aggregate risks on an enterprise-wide basis. Under the Company’s ERM program, management identifies various risks facing the Company and assesses such risks by likelihood of occurrence and potential impact on earnings.impact. Management has the responsibility for developing an action plan to address, mitigate or monitor such risks. Management updates the ERM program annually to reassess existingits risk profilesprofile and to identify new risks that maymight need to be incorporated into the assessment. In fiscal 2015,2016, the Board of Directors retained overall responsibility for overseeing risk assessment for the enterprise in light of the interrelated nature of the elements of risk. However, the Board has delegated certain risk rather than delegating this responsibilityareas for inquiry and monitoring to a Board committee.committees. As described below, the Board receives assistance from certain of its committees for the identification and monitoring of those risks that are related to the committees’ areas of focus as described in each committee charter. The Board and its committees exercise their risk oversight function by carefully evaluating management reports and making inquiries of management regarding material risk exposures and the steps taken to control such exposure. The Audit Committee reviews risks related to internal controls, disclosure, financial reporting, and legal and compliance activity. Oversight of some compliance activities, including trade compliance risks and business ethics programs in particular, is shared with the Enterprise Risk Committee, as further described below. Among other processes, the Audit Committee meets -7-

regularly in executive sessions with our internal auditors and external auditorsaccounting firm as well as the Chief Financial Officer, Chief Accounting Officer, and the General Counsel. In addition, theThe Audit Committee met in executive session with our accounting firm, Ernst & Young LLP, as part of each of the four regular meetings held in fiscal 2016. In February 2016, the Board formed an Enterprise Risk Committee that is focused on supporting the Board’s oversight of enterprise risk management, including the ERM described above, trade compliance programs and risks and corporate acquisition and divestiture transactions and key research and development (“R&D”) opportunities. The corporate transactions and R&D oversight areas were previously supported by a Strategy & Technology Committee, which was replaced by this Enterprise Risk Committee. With the formation of the Enterprise Risk Committee, the Regulatory Compliance Subcommittee (the “Subcommittee”), which was formed in August 2013 to support and enhance the Audit Committee’s oversight of the Company’s risk management and related activities associated with trade compliance. More specifically,export control compliance, is now overseen the Enterprise Risk Committee rather than by the Audit Committee. The Subcommittee was delegated and has retained the authority to oversee the Company’s export control compliance activities and program development resulting from its obligations under the Consent Agreement entered into in March 2014 (the “Consent Agreement”) with the U.S. Department of State’s Directorate of Defense Trade Controls Office of Defense Trade Controls Compliance (DDTC) to resolve alleged International Traffic in Arms Regulations (ITAR) civil violations. The Compensation Committee reviews risks associated with the Company’s compensation programs, to ensure that incentive compensation arrangements for employees do not encourage inappropriate risk taking, as described more fully under the Statement Regarding Compensation Practices section in this proxy statement on page 31.30. Attendance at the Annual Meeting. The Board of Directors currently does not have a policy with regard to director attendance at the Company’s annual shareholders meeting; however, it schedules the second fiscal quarter meeting of the Board of Directors on the same date as the annual shareholders meeting to facilitate director attendance at the annual meeting. All but one of the Company’s directors then-serving as a directorthen serving on the Board attended the annual shareholders meeting in 2015.2016. 7

Board Independence. The Board has reviewed the relationships between the Company and each director and has determined that a majority of the directors are independent for purposes of the NYSE corporate governance listing standards. In accordance with these listing standards, the Board adopted its own set of specified criteria, identified in the Company’s Corporate Governance Guidelines which are posted on the Company’s website atwww.esterline.com under the Corporate Governance tab, to assist it in determining whether any relationship between a director and the Company impairs independence. Using the adopted criteria, the Board affirmatively determined that all of the directors, other than Mr. Reusser, are independent under the NYSE listing standards. Mr. Reusser does not meet NYSE independence listing standards due to his current positions as Chairman, President and Chief Executive Officer of the Company. The Audit Committee currently consists of directors Kuechle (Chairman), Haack, Howell, and Morris, each of whom is independent in accordance with applicable rules promulgated by the Securities and Exchange Commission (“SEC”) and NYSE listing standards. Mr. Morris has informed the Board of Directors of his intention to retire from the Board of Directors and its committees at the expiration of his current term at the conclusion of the 2017 annual meeting, and therefore will not stand for reelection at the 2017 annual meeting. The Audit Committee selects and retains the independent registered public accounting firm to audit the Company’s annual financial statements, approves the terms of the engagement of, and the selection of the lead partner from, the independent registered public accounting firm and reviews and approves the fees charged for audits and for any non-audit assignments. The Board of Directors has adopted a written charter for the Audit Committee, a copy of which is posted on the Company’s website atwww.esterline.com under the Corporate Governance tab. The Audit Committee’s responsibilities also include, among others, overseeing (1) the integrity of the Company’s financial statements, which includes reviewing the scope and results of the annual audit by the independent registered public accounting firm, any recommendations of the independent registered public accounting firm resulting therefrom and management’s response thereto and the accounting principles being applied by the Company in financial reporting, (2) the Company’s compliance with legal and regulatory requirements, (3) the independent registered public accounting firm’s qualifications and independence, (4) the performance of the Company’s internal auditors and the independent registered public accounting firm, and (5) such other related matters as may be assigned to it by the Board of Directors. The Audit Committee met eightseven times during fiscal 2015.2016. The Board of Directors has determined that Messrs. Haack and Kuechle each qualify as an “audit committee financial expert” as defined in Item 407 of Regulation S-K promulgated by the SEC and that each Audit Committee member has accounting and financial management literacy under NYSE listing standards. In August 2013, the Audit Committee formed a Regulatory Compliancethe Subcommittee to support and enhance the Audit Committee’s oversight of the Company’s risk management and related activities associated with trade compliance. The Subcommittee’s oversight is focused on the Company’s compliance activities resulting from its obligations under the Consent Agreement. In fiscal 2016, oversight of the Subcommittee was shifted to the Enterprise Risk Committee, which was formed in February 2016 and oversees export control risks, including those risk areas impacted by the Consent Agreement. The Regulatory Compliance Subcommittee currently consists of directors Howell (Chair), Etter, Kuechle and Morris. -8-

The Compensation Committee currently consists of directors Franceschini (Chairman), Etter, Haack, and Pruitt, each of whom is independent in accordance with applicable NYSE listing standards. The Compensation Committee develops, evaluates and recommends to the independent members of the Board for its approval corporate goals and objectives relevant to the compensation of the Chief Executive Officer; evaluates the Chief Executive Officer’s performance and that of other corporate officers in light of corporate goals and objectives; develops, evaluates and recommends the form and level of compensation for the CEO and other officers of the Company; recommends compensation for Board members; oversees the Company’s succession planning process; and is responsible for performing the other related responsibilities set forth in its written charter, which is posted on the Company’s website atwww.esterline.com under the Corporate Governance tab. The Compensation Committee also administers the Company’s equity and incentive compensation plans for officers and senior corporate management, which includes recommending amendments to such plans. When appropriate, the Compensation Committee may form and delegate authority to subcommittees, or may delegate authority to one or more designated members of the Board or to corporate officers. The Chief Executive Officer, the Executive Vice President and Chief Human Resources Officer, and the Executive Vice President & General Counsel are non-voting advisors to the Compensation Committee from whom the Compensation Committee solicits and considers recommendations as to compensation for the other executive officers as well as other matters related to the Company’s executive compensation program. The Compensation Committee has the sole authority from the Board of Directors for the appointment, compensation, and oversight of the Company’s outside executive and director compensation consultant. The Compensation Committee has engaged Semler Brossy, an independent executive compensation consultant, to: (1) review and develop compensation program recommendations for Company executives and directors; (2) provide and analyze benchmark compensation data for executive officers and directors from peer companies and from general compensation surveys; (3) advise the Committee on compensation levels for executive officers and directors; and (4) provide analysis and recommendations related to the design of executive incentive plans. Semler Brossy does no other work for and has no other business relationships with Esterline. The firmcompensation consultant reports directly to the Committee, and the Committee may replace the firm or hire additional consultants at any time. A representative of the firmcompensation consultant attends meetings of the Committee, upon request, and communicates with the Committee chair between meetings. The Compensation Committee met fivesix times and acted by unanimous consent in lieu of a meeting once during fiscal 2015. 2016.8

The Nominating & Corporate Governance Committee currently consists of directors Etter (Chair), Cave, Franceschini, and Pruitt, each of whom is independent in accordance with applicable NYSE listing standards. The Nominating & Corporate Governance Committee recommends director candidates to the entire Board, oversees the evaluation of the Board of Directors and Company management, develops and monitors corporate governance principles, practices and guidelines for the Board of Directors and the Company, and is responsible for performing the other related responsibilities set forth in its written charter, which is posted on the Company’s website atwww.esterline.com under the Corporate Governance tab. The Nominating & Corporate Governance Committee met fiveseven times during fiscal 2015.2016. The ExecutiveEnterprise Risk Committee currently consists of directors Reusser (Chairman), Franceschini, Haack,was formed in February 2016 and Pruitt. The Executive Committee reviews matters that might, at some future time, become items for consideration of the entire Board of Directors and acts on behalf of the entire Board of Directors between its meetings. The Strategy & Technology Committee currently consists of directors Morris (Chairman), Cave, Etter, Howell, and Kuechle. Mr. Morris has informed the Board of Directors of his intention to retire from the Board of Directors and its committees at the expiration of his current term at the conclusion of the 2017 annual meeting, and therefore will not stand for reelection at the 2017 annual meeting. The Strategy & TechnologyEnterprise Risk Committee provides oversight for the Company’s enterprise risk management program, and for risks associated with export control, business ethics, cyber security, corporate transactions, and research and development investment opportunities. Oversight of the Company’s export control program has been delegated to the Subcommittee of the Enterprise Risk Committee, as further described under “Board’s Role in Risk Oversight” on page 7. In addition, the Enterprise Risk Committee reviews and makes recommendations to the Board of Directors regarding business acquisition and technology acquisitionsale opportunities monitors and evaluates the execution and performance of significant new product and technology launches, and monitors and evaluates the Company’skey research and development programs.opportunities that were formerly overseen by a Strategy & Technology Committee, which was replaced by this new Enterprise Risk Committee.

Director Nominations and Qualifications In accordance with the Company’s Amended and Restated Bylaws, any shareholder entitled to vote for the election of directors at the annual meeting may nominate persons for election as directors at the 20162018 annual shareholders meeting only if the Corporate Secretary receives written notice of any such nominations not fewer than 120 days nor more than 150 days prior to the date of the annual meeting. It is anticipated that the 2018 annual meeting will be held on February 8, 2017, in which case the Corporate Secretary must receive written notice of any such nominations no earlier than September 19, 2016,11, 2017, and no later than October 20, 2016.11, 2017. Such nominations should be sent to: Esterline Technologies Corporation, Attn: Corporate Secretary, 500 108th Avenue NE, Suite 1500, Bellevue, WA 98004 and comply with the requirements set forth in our Bylaws. The Chairman of the Board, other directors or senior management of the Company may also recommend director nominees. The Nominating & Corporate Governance Committee will evaluate recommended director nominees,nominees, including those that are submitted to the Company by a shareholder, taking into consideration certain criteria such as business or community leadership experience, policy-making experience, record of accomplishments, personal integrity and high moral -9-

responsibility, capacity to evaluate strategy and reach sound conclusions and current Board composition. In addition, prospective directors must have time available to devote to Board activities and be able to work well with the Chief Executive Officer and other members of the Board. Although there is no formal diversity policy in place, the Company and the Nominating & Corporate Governance Committee value board members with varying viewpoints, backgrounds, and experiences. They consider candidates’ diverse backgrounds as a favorable asset in identifying nominees for director. One new director nominee, Michael J. Cave,Mr. Nils E. Larsen, is being presented to the shareholders for election at the Annual Meeting. Mr. CaveLarsen was initially identified as a potential nominee by oneFirst Pacific Advisors, LLC, our largest shareholder, as part of the Company’s directors. Pursuant tonegotiation of the process described above, theFPA Agreement. The Nominating and& Corporate Governance Committee evaluated Mr. CaveLarsen as a director nominee as part of an internal search process for potential candidates overseen by the Committee. Following this process, Mr. Cave was recommendedand determined to recommend him for appointment to the Board of Directors, bywhich recommendation the NominatingBoard adopted as part of its approval of the terms of the FPA Agreement. See the “Certain Relationships and Corporate Governance Committee.Related Transactions – The FPA Agreement” section of this proxy statement beginning on page 42 for further detail on the FPA Agreement. TheOther than with respect to Mr. Larsen as described above, the Company did not receive any shareholder nominations for directors to be considered by the Nominating & Corporate Governance Committee for the 20162017 annual shareholders meeting.

9

Communications with the Board Shareholders, and other interested parties, may contact Mr. Reusser, as the Chairman, Mr. Haack, as the Lead Independent Director, the non-management directors as a group, the Board of Directors as a group or an individual director by the following means: Email: | | boardofdirectors@esterline.com | Email:

| | boardofdirectors@esterline.com

| | | Mail: | | Board of Directors | | | Attn: Lead Independent Director or Corporate Secretary | | | Esterline Technologies Corporation | | | | 500 108th108th Avenue NE, Suite 1500 | | | Bellevue, WA 98004 |

Each communication should clearly specify the name of the individual director or group of directors to whom the communication is addressed. Communications sent by email are delivered directly to the Lead Independent Director and to the Corporate Secretary, who will promptly forward such communications to the specified director addressees. Communications sent by mail will be promptly forwarded by the Corporate Secretary to the specified director addressee or, if such communication is addressed to the full Board of Directors, to the Chairman of the Board and the Lead Independent Director, who will promptly forward such communication to the full Board of Directors. Shareholders wishing to submit proposals for inclusion in the proxy statement relating to the 20172018 annual shareholders meeting should follow the procedures specified under Shareholder Proposals for 20172018 in this proxy statement. Shareholders wishing to nominate or recommend directors should follow the procedures specified under the Other Information as to Directors—Director Nominations and Qualifications section above. CODE OF ETHICS The Company has adopted a code of ethics that applies to its accounting and financial employees, including the Chief Executive Officer and Chief Financial Officer. This code of ethics, which is included as part of the Company’s Code of Business Conduct and Ethics that applies to the Company’s employees and directors, is posted on the Company’s website atwww.esterline.com under the Corporate Governance tab. The Company intends to satisfy the disclosure requirement under Item 5.05 of Form 8-K regarding an amendment to or waiver from application of the code of ethics provisions of the Code of Business Conduct and Ethics that applies to the Chief Executive Officer or the Chief Financial Officer, and any other applicable accounting and financial employee, by posting such information on its website atwww.esterline.com under the Corporate Governance tab. -10-

10

SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT The following table sets forth certain information regarding beneficial ownership of shares of Common Stock as of December 16, 2015,14, 2016, by (i) each person or entity who is known by the Company to own beneficially more than 5% of the Common Stock, (ii) each of the Company’s directors, (iii) each of the Company’s Named Executive Officers (“NEOs”) who are further defined in the Compensation Discussion and Analysis section of this proxy statement on page 12 (“NEOs”) and (iv) all directors and executive officers of the Company as a group. Name and Address of Beneficial Owner (1) | | | Amount and Nature of Beneficial Ownership (2) | | | Percent of Class | | | | | | | | | | | | | | | | | | | Name and Address of Beneficial Owner (1) | | Amount and Nature

of Beneficial

Ownership (2) | | Percent of Class | | First Pacific Advisors, LLC

11601 Wilshire Boulevard, Suite 1200, Los Angeles, CA 980025 | | | 3,168,360 | (3) | | 10.7% | | BlackRock, Inc

40 East 52nd Street, New York, NY 10022 | | | 2,748,406 | (4) | | 9.3% | | Dimensional Fund Advisors LP

Palisades West – Bldg. One, 6300 Bee Cave Road, Austin, TX 78746 | | | 2,341,819 | (5) | | 7.9% | | The Vanguard Group, Inc

100 Vanguard Boulevard., Malvern, PA 19355 | | | 1,761,717 | (6) | | 6.0% | | MSD Capital, L.P

645 Fifth Avenue, 21st Floor, New York, NY 10022 | | | 1,624,578 | (7) | | 5.5% | | First Pacific Advisors, LLC | | | | 3,690,774 | | (3 | ) | | | 12.5% | | 11601 Wilshire Boulevard, Suite 1200, Los Angeles, CA 98025 | | | | | | | | | | | | BlackRock, Inc. | | | | 3,144,101 | | (4 | ) | | | 10.6% | | 40 East 52nd Street, New York, NY 10022 | | | | | | | | | | | | Dimensional Fund Advisors LP | | | | 2,230,792 | | (5 | ) | | | 7.5% | | Palisades West - Bldg. One, 6300 Bee Cave Road, Austin, TX 78746 | | | | | | | | | | | | The Vanguard Group, Inc. | | | | 2,191,954 | | (7 | ) | | | 7.4% | | 100 Vanguard Boulevard, Malver, PA 19355 | | | | | | | | | | | | FMR LLC | | | | 2,087,165 | | (6 | ) | | | 7.0% | | 82 Devonshire Street, Boston, MA 02109 | | | | | | | | | | | | Robert D. George | | | 148,728 | (8) | | * | | | 137,003 | | (8 | ) | | * | | Curtis C. Reusser | | | | 74,324 | | (8 | ) | | * | | Marcia J. Mason | | | 55,776 | (8) | | * | | | 67,013 | | (8 | ) | | * | | Frank E. Houston | | | 53,735 | (8) | | * | | Curtis C. Reusser | | | 38,824 | (8) | | * | | Albert S. Yost | | | 23,963 | (8) | | * | | Paul V. Haack | | | 21,802 | | | * | | | 23,883 | | | | | * | | Anthony P. Franceschini | | | 17,043 | | | * | | | 19,124 | | | | | * | | Albert S. Yost | | | | 19,716 | | (8 | ) | | * | | James J. Morris | | | 15,269 | | | * | | | 17,350 | | | | | * | | Alain M. Durand | | | 11,187 | (8) | | * | | Delores M. Etter | | | 9,306 | | | * | | | 11,387 | | | | | * | | Gary E. Pruitt | | | 7,481 | | | * | | | 9,562 | | | | | * | | Mary L. Howell | | | 7,171 | | | * | | | 9,252 | | | | | * | | Scott E. Kuechle | | | 3,331 | | | * | | | 5,412 | | | | | * | | Paul P. Benson | | | 1,625 | (8) | | * | | Roger A. Ross | | | | 4,842 | | (8 | ) | | * | | Michael J. Cave | | | — | | | * | | | 2,081 | | | | | * | | Directors, nominees and executive officers as a group (16 persons) | | | 415,241 | (8) | | 1.4% | | Nils E. Larsen | | | | - | | | | | * | | Directors, nominees and executive officers as a group (15 persons) | | | | 404,699 | | (8 | ) | | | 1.4% | |

______________________ *Less than 1% (1) | Unless otherwise indicated, the business address of each of the shareholders named in this table is Esterline Technologies Corporation, 500 108th Avenue NE, Suite 1500, Bellevue, Washington 98004. |

(2) | Beneficial ownership is determined in accordance with Rule 13d-3 under the Securities Exchange Act. In computing the number of shares beneficially owned by a person or a group and the percentage ownership of that person or group, shares of Common Stock subject to options currently exercisable or exercisable within 60 days after January 13, 2015,December 14, 2016, are deemed outstanding, but are not deemed outstanding for the purpose of computing the percentage ownership of any other person. As of December 16, 2015,14, 2016, there were 29,606,88529,640,800 shares of Common Stock outstanding. Unless otherwise indicated in the footnotes to this table, the person and entities named in the table have sole voting and sole investment power with respect to all shares beneficially owned, subject to community property laws where applicable. |

(3) | The information on the number of shares held is based upon a Schedule 13G13D filed on October 9, 2015,19, 2016, on behalf of First Pacific Advisors, LLC (“FPA”). Based upon such filing, FPA beneficially owns 3,168,3603,690,774 shares. |

(4) | The information on the number of shares held is based on a Schedule 13G filed on January 22, 2015,December 9, 2016, on behalf of BlackRock, Inc. (“BlackRock”). Based upon such filing, BlackRock beneficially owns 2,748,4063,144,101 shares. BlackRock has sole voting power over 3,085,583 shares and sole dispositive power over 3,144,101 shares. |

(5) | The information on the number of shares held is based upon a Schedule 13G filed on February 5, 2015,9, 2016, on behalf of Dimensional Fund Advisors LP (“Dimensional”). Based upon such filing, Dimensional is an investment advisor registered under Section 203 of the Investment Advisors Act of 1940. Dimensional furnishes investment advice to four investment companies registered under the Investment Company Act of 1940, and serves as investment manager to certain other investment vehicles, including commingled group trusts. These investment companies and investment vehicles are the “Funds.” In its role as investment advisor or investment manager, Dimensional possessed sole voting and investment power over all of the shares. The Funds own all of the shares, and Dimensional |

-11-

| disclaims beneficial ownership of such shares. Dimensional has sole voting power over 2,304,9512,205,098 shares and sole dispositive power over 2,341,8192,230,792 shares. |

11

(6) | The information on the number of shares held is based upon an ownership questionnaire dated December 6, 2016, on behalf of The Vanguard Group (“Vanguard”). Based upon such questionnaire, Vanguard beneficially owns 2,191,954 shares as of September 30, 2016. |

(7) | The information on the number of shares held is based upon a Schedule 13G filed on February 11, 2015,12, 2016, on behalf of The Vanguard GroupFMR LLC (“Vanguard”FMR”). Based upon such filing, VanguardFMR beneficially owns 1,761,7172,087,165 shares. |

(7) | The information on the number of shares held is based upon a Schedule 13G filed on December 29, 2014, jointly and on behalf of MSD Capital, L.P., MSD Value Investments, L.P., and Michael S. Dell (collectively “MSD”). Based upon such filing, MSD beneficially owns 1,624,578 shares.(8)

|

(8) | Includes shares subject to options granted under the Company’s 2004 Equity Incentive Plan and the Company’s 2013 Equity Incentive Plan which are exercisable currently or within 60 days of December 16, 2015,14, 2016, as follows: Mr. Reusser, 18,125;38,025; Mr. George, 137,450 shares; Mr. Benson, 1,625124,200 shares; Ms. Mason, 50,675;60,725 shares; Mr. Ross, 3,825; Mr. Yost, 19,325 shares; Mr. Durand, 7,975 shares; Mr. Houston, 52,40013,800 shares; and directors, nominees and executive officers as a group, 287,575244,325 shares. |

EXECUTIVE COMPENSATION COMPENSATION DISCUSSION AND ANALYSIS Introduction The following discussion describes and analyzes Esterline’s compensation program for its NEOs. For fiscal 2015,2016, our NEOs are: •Curtis C. Reusser, Chairman, President & Chief Executive Officer (“CEO”); •Robert D. George, Executive Vice President, Chief Financial Officer (“CFO”), & Corporate Development; Paul P. Benson, Vice President & Chief Human Resources Officer;

•Marcia J. Mason, Executive Vice President & General Counsel; •Roger A. Ross, Executive Vice President and President, Sensors & Systems; •Albert S. Yost, Executive Vice President and President, Advanced Materials and Avionics & Controls Segment and Advanced Materials Segments; Alain M. Durand, Former President, Sensors & Systems Segment; and

Frank E. Houston, Former President, Avionics & Controls Segment.

During fiscal 2015, Esterline experienced several management changes, as follows:Controls;

Mr. Benson was appointed as Vice President, Human Resources in December 2014, following the retirement of our former Vice President, Human Resources. Mr. Benson’s title was changed to Vice President & Chief Human Resources Officer in April 2015. Further details on the compensation arrangements with Mr. Benson are described below in this CD&A.

In March 2015, Mr. Yost’s responsibilities as Treasurer were transitioned to a newly created position of Senior Director, Investor Relations & Treasurer.

In August 2015, Esterline consolidated its senior operational leadership under two segment presidents, Mr. Yost and Mr. Roger A. Ross. The key leadership changes associated with this consolidation were the following:

Effective August 14, 2015, Mr. Houston retired as President, Avionics & Controls Segment, and entered into a Retirement Transition Agreement and Release with Esterline, which is further described below in this CD&A (the “Houston Agreement”).

Effective August 14, 2015, Mr. Durand resigned as President, Sensors & Systems Segment, and entered into a Transition Agreement and Release with Esterline, which is further described below in this CD&A (the “Durand Agreement”).

Mr. Yost assumed management responsibility for the Avionics & Controls segment effective August 15, 2015, in addition to his management responsibility for the Advanced Materials segment. Mr. Yost’s annual base pay was increased, and he was granted a restricted stock unit award in connection with his new responsibilities, as further described later in this CD&A.

Mr. Ross was appointed as the Company’s new President, Sensors & Systems Segment, effective August 24, 2015.

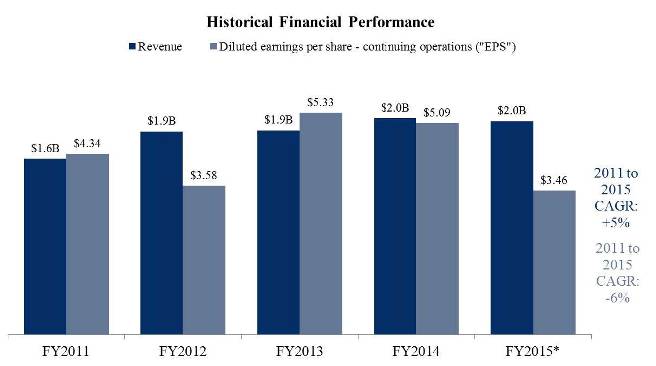

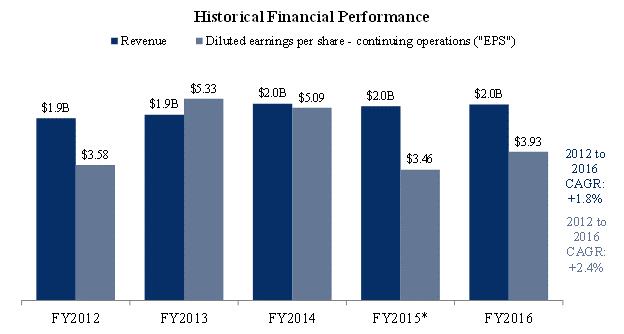

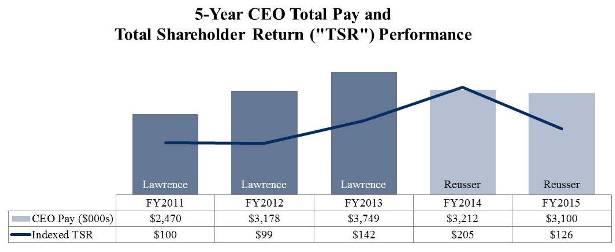

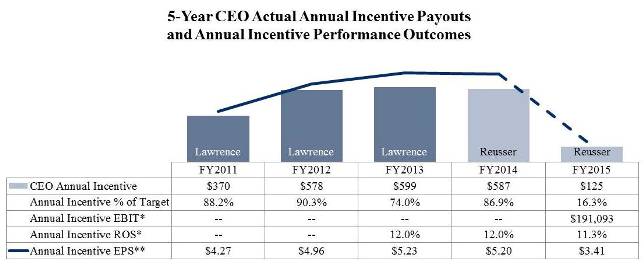

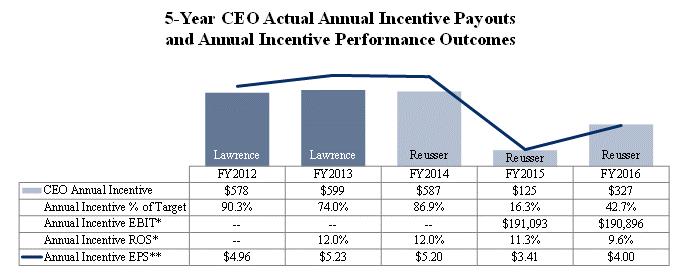

Executive Summary The key events related to Company performance and resulting executive compensation decisions in fiscal 20152016 are outlined briefly below and described more fully in later sections of this CD&A. As detailed further below, fiscal 2016 was a challenging year for the Company experiencedoverall that fell short of expectations. The key events impacting fiscal 2016 performance were as follows: The Company’s financial performance in fiscal 2016 began with a challenging transitionalweaker than expected first quarter impacted by weak product demand and delays in orders across a number of markets and end customers as well as internal execution challenges that impacted our expected profitability. As a result, the Company re-baselined its financial performance expectations for full year fiscal 2016. The Company completed the year by achieving those re-set targets, ending with fourth quarter financial results that included some difficult market conditions,were stronger across most key metrics, including earnings from continuing operations, than results achieved in the fourth quarter of fiscal 2015. The Company continued executionto make progress during the fiscal year on key initiatives to better position the Company for future growth, including the completion of the accelerated integration projects initially identified in fiscal 2014 and a transitioncontinued progress and investment in the Company’s trade compliance program. These projects focused on consolidating certain facilities and creating greater cost-efficiency through shared services in sales, general administrative and support functions. The Company’s results were also impacted by discrete effects related to a new fiscal year end. corporate transactions and long-term contracts. The combination of these 12

items contributed toCompany’s financial performance that was lower than expectations, and consequently,results are reflected in incentive payouts to our NEOs that were significantly below target – under both the fiscal 20152016 annual incentive planprogram and the 2014-2016 long-term incentive plan (“LTIP”) were significantly. More information about the key drivers for the Company’s performance in fiscal 2016 is contained below both target levels and prior year payouts.under “Company Performance in Fiscal 2016” on page 19.

In fiscal 2015, Esterline transitioned its fiscal year to end approximately one month earlier than in prior years. As a result, the Company’s financial results in fiscal 2015 wasas reported in last year’s CD&A were for an 11-month11month transition year that ended on October 2, 2015. All2015, subject to certain exceptions that were noted in last year’s CD&A. However, in this CD&A, all financial results for fiscal 2016 are for the fiscal year ended September 30, 2016, and unless otherwise noted, all financial results for fiscal 2015 are recast for the 12 months ended October 2, 2015, so as to provide more meaningful comparisons between the -12-

two fiscal years. Consequently, the Company’s financial results for recast fiscal 2015 reported in this CD&A are not the same as the Company’s financial results for the 11-month11month period ending October 2, 2015, unless otherwise noted. In addition, for purposes of comparisonthat were reported in thislast year’s CD&A, we used the financial results for the 11-month period ended September 26, 2014, as our financial results for fiscal 2014, unless otherwise noted.&A. Financial Performance Summary

The key aspects of our financial performance for fiscal 2015 were as follows:

The Company’s financial results for fiscal 2015 were down significantly from fiscal 2014 and below what the Company expected to achieve for the year as we ended with income from continuing operations of $96.7 million, or $3.10 per diluted share, which was down over 25% from fiscal 2014. Our financial performance was impacted by continued softness in defense markets, foreign exchange rate volatility, oil price realignment and stagnation of economic growth in Europe. In the face of these conditions, the Company generated very strong cash flows from operations in fiscal 2015 of $144.3 million, or approximately 149% of our fiscal 2015 income from continuing operations.

The Company continued to execute on the accelerated integration projects launched in fiscal 2014 and to invest in its compliance program, driven in significant part by the requirements of the Company’s Consent Agreement with the Department of State’s office of Defense Trade Control Compliance (“DTCC”), which was entered into in fiscal 2014.

In addition to the challenging market conditions and continued investment in our compliance program and efforts to complete the accelerated integration projects described above, we experienced several discrete events associated with corporate transactions that had a significant impact on our fiscal 2015 financial performance. The details of these events and their related impacts are described below in more detail under “Company Performance in Fiscal 2015” on page 20.

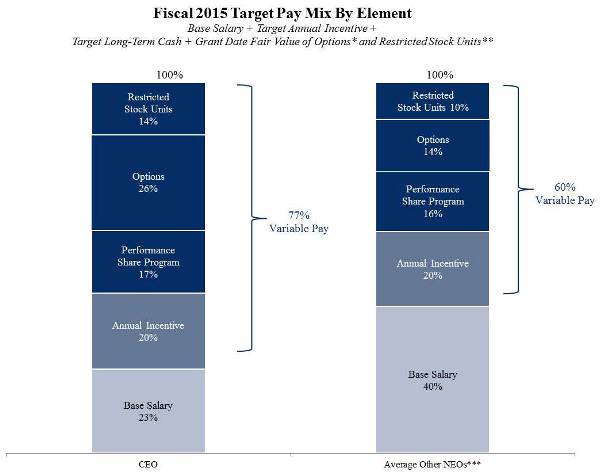

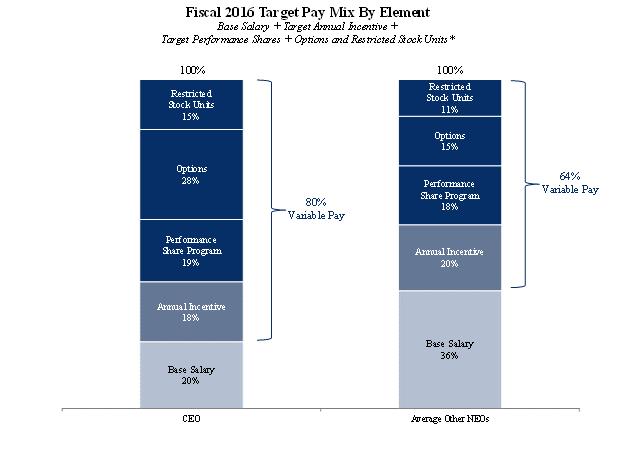

Key Compensation Decisions Base salaries and target annual and LTI program award opportunities for NEOs other than Messrs. Reusser and Benson, for 2015 were moderately increasedeither remained unchanged from fiscal 20142015 amounts or increased moderately for fiscal 2016 to acknowledge strength of individual performance and to align them more closely with the competitive market. Mr. Reusser’s long-term target opportunity was increased from 250% of base salary to 300% to help reposition his target pay opportunity relative to competitive references – moving from a low competitive baseline when Mr. Reusser receivedjoined Esterline to a 13.3% salary increase atlevel more aligned with the beginningCompany’s intended competitive positioning for executive roles in light of fiscal 2015 to reflect his strong performance in 2014 and to recognize that his salary was below the competitive market. Mr. Reusser did not receive a salary increase for fiscal 2016. Base salary for Mr. Benson was first established in connection with his appointment as an executive officer of the Company.CEO role. Our fiscal 20152016 annual incentive program was based on earnings from continuing operations before interest and taxes (“EBIT”), return on sales (“ROS”), and the achievement of performance objectives under our strategic plan established at the beginning of the year. The EBIT target and ROS target for fiscal 2015, both of which anticipated the 11-month transition period for fiscal 2015,2016 were $256.6$231.0 million and 13.6%11.0%, respectively. While there was no payout toBased on below-target achievement of each financial metric and the NEOs based on the Company’s financial performance,preestablished strategic objectives, each NEO earned a payout that was paid 16.3%42.7% of target based on achievement of the pre-established strategic objectives.target. The 2013–20152014–2016 performance cycle of the cash-based LTIP was based on average return on invested capital (“ROIC”) and earnings per share (“EPS”) growth, with three-yearthreeyear targets of 9.3% and 10%10.0%, respectively. Actual ROIC and EPS performance, including the adjustments described later in this CD&A were below these targets. As a result, no payouts were made to our NEOs for the 2013–20152014–2016 performance cycle under the cash-based LTIP. The Committee believes that the fiscal 20152016 pay decisions were appropriate in light of the Company’s performance and that the overall pay program continues to align pay and performance over time. Changes to Annual and Long-Term Incentive Compensation Programs in 2015

Fiscal 2015 marked a year of transition for our executive pay programs. As previewed in last year’s proxy statement, the Committee made changes for 2015 to the annual incentive and long-term incentive programs. These changes were designed to meet key objectives: (i) linking performance measurement more directly to the Company’s strategic plan, and (ii) strengthening executives’ alignment with shareholders through equity compensation.

13

Each of the changes below is explained in more detail throughout the remainder of the CD&A:

In the annual incentive program, the Committee moved to EBIT in place of EPS. EBIT sharpens the performance focus to the Company’s core business results in the year. In balance with EPS in the long-term plan, our overall pay-for-performance framework addresses directly the Company’s earnings and profitability over time.

A new strategic component for the annual incentive program was introduced in the 2015 performance year. This strategic component focuses executive attention on five critical areas of performance, beyond our financial results, based on specific performance objectives within the Company’s strategic plan.